If not, click certification and submit your application. If you are not eligible for withdrawal, then the request will be marked red. Select the ‘Purpose for which advance is required’.Select the ‘PF Advance (Form 31)’ button.Click the ‘Yes’ button and then click the ‘Proceed for Online Claim’ option.Enter the last 4 digits of your bank account and then click “Verify”. Click the ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’.Go to the EPF Portal and sign in using your UAN and password.Step-by-step EPF Online Withdrawal Process

In case the employee is withdrawing the amount before 5 consecutive years of service, then he or she is to provide ITR Form 2 and ITR Form 3 to prove the amounts deposited to the account in the previous year. Cancelled cheque with clearly visible IFSC code and account number.

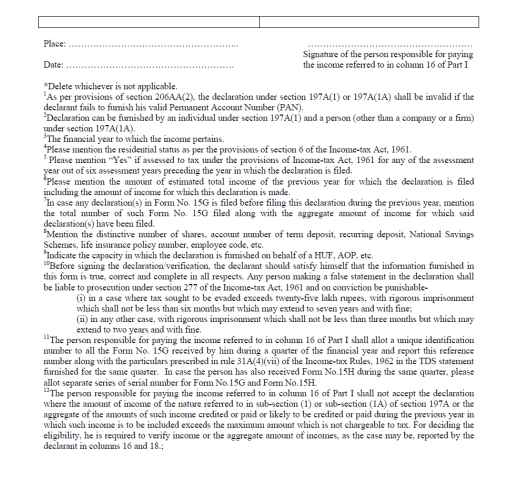

When he or she needs the funds for some emergency purpose.When he or she retires from active service.When the employee is no longer employed.In that scenario, the bank will start deducting TDS from the next interest payment onwards.Given below is a detailed procedure to undertake this task of withdrawal of your EPF online. However, if your total income exceeds the exemption limit after submitting form 15G or 15H, then it is advisable to withdraw form 15G. In such a scenario, tax payer must intimate the same to the relevant bank or financial institution to prevent deduction of TDS. Now, let us assume that taxpayer is not supposed to pay any tax since his total income at the end of the year falls short of the taxable income. To avail this benefit, tax payer must furnish an application in requisite format before the tax department. This application for deducting lower tax is made under section 197 of the Income Tax (I-T) Act, 1961. There is another provision wherein tax payer can apply for lower or nil deduction of tax at source. And when the overall tax liability turns out to be lower than the TDS, taxpayer can claim refund at the time of return filing process. To be able to understand the need to submit the form, one must first understand the process of deduction of TDS on interest income.Īt the time of transfer of interest income, banks deduct 10 percent tax on interest income when interest income exceeds ₹40,000 (50,000 for senior citizens).Īnd in case the overall tax liability is more than 10 percent, taxpayers are supposed to pay the balance tax at the time of filing of income tax return (ITR).

0 kommentar(er)

0 kommentar(er)